Amassed Insights #5: AI in Investing

Deploying AI within Hedge Funds is Starting to Make a Real Difference, plus Yipit v. M Science Going to Trial?

Increasing Adoption of AI within Investing

As I was curating the most impactful news to include in this edition covering the past 6 weeks of the alternative data industry and reflecting back on my last Alternative Data Breakfast event, it became clear what the theme needed to be: that "Wall Street is moving out of the pilot phase of AI into live deployments" (credit to Matt Robinson, who solely focuses on this topic in his blog, AI Street). As you may notice in the new provider section below, almost every new data vendor we add to our industry-leading directory employs generative AI models to some extent. Almost every data-driven hedge fund I've talked to has been testing and tinkering with generative AI models for at least the past year or two and has begun to find evidence of efficiency gains for narrow use cases (for now). The most common use cases I've seen include automating the mundane pieces of investment research such as synthesizing multiple data sources into a coherent investment memo or generating documentation and code to quickly assess and analyze a new data source. This has led many to expand the scope of their AI exploration and collaborate more closely with the hyperscalers for mutual benefit. Clearly if you're still burying your head in the sand and ignoring integrating LLMs into various aspects of your investment process, you're going to be left behind.

The most obvious examples of the potential for using AI in improving an investor's workflows come directly from some of the largest AI companies. Their playbooks have started to converge: build the best/biggest general-purpose LLMs, partner with best-in-breed data providers and data tools to ground the models in real-world data & their clients' proprietary data, and tune the models and the interface for investors' unique use cases and workflows. Perplexity was first to market with a model purpose-built for the finance space, Perplexity Finance, in which they partnered with Financial Modeling Prep for general financial market data, Unusual Whales for options data, Quartr for live transcripts, and Fiscal.ai for revenue and EPS data:

- Financial Modeling Prep (Data Profile)

- Main Data Category: Financial Market Data

- Brief: Provides access to stock market information (news, currencies and stock prices).

- Unusual Whales (Data Profile)

- Main Data Category: Market Trades or Transactions

- Brief: Provides alerts on stock and options flow movements.

- Quartr (Data Profile)

- Main Data Category: Filing Data

- Brief: Gives investors access to company information – including presentations and earnings calls.

- Fiscal.ai (Data Profile)

- Main Data Category: Financial Data-Driven Investment Research

- Brief: An AI-powered investment research platform for long-term retail investors that generates answers to questions about public companies and investors.

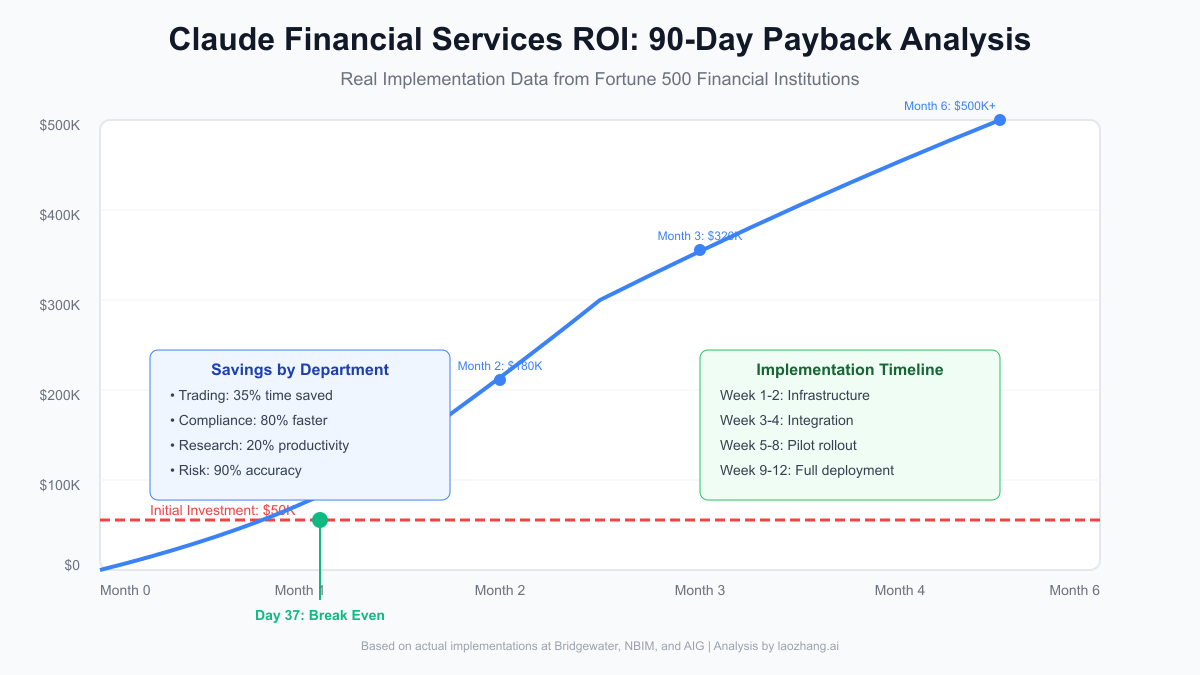

Anthropic's Claude just kicked the door in with the announcement of their Claude for Financial Services product. Is this AI’s Goldman Sachs moment? You can see more details how the product can be used in the video below, but they've announced significant collaborations with some of the largest asset managers including Norges Bank (NBIM), Bridgewater, DE Shaw, AIG, and Commonwealth Bank. And I came across a detailed implementation guide for Claude Financial Services complete with an ROI analysis and a comparison to the competition. Natively within this product, they've integrated the following data providers:

- FactSet (Data Profile)

- Main Data Category: Financial Market Data

- Brief: Offers risk analytics tools and real time data feeds for institutional investors.

- Morningstar (Data Profile)

- Main Data Category: Investment Research

- Brief: Provides data and research insights on investment offerings, including managed investment products, publicly listed companies, private capital markets, and real-time global market data.

- S&P Global Market Intelligence (Data Profile)

- Main Data Category: Financial Market Data

- Brief: Integrates financial and industry data, research, and news.

- PitchBook (Data Profile)

- Main Data Category: Company Information

- Brief: Data on investors, funds, LPs and service providers involved in M&A, PE and VC transactions.

- Daloopa (Data Profile)

- Main Data Category: Filing Data

- Brief: Extracts and organizes data from millions of financial reports, investor presentations, and supplemental data files.

And finally, OpenAI seems to want to compete with Anthropic in every way possible, and Daloopa announced their data is now integrated into ChatGPT as well.

As you'll see in most of the industry updates highlighted below, AI is driving a lot of the innovation and also causing a lot of headaches with regards to compliance concerns. It's still very unclear what should and shouldn't be allowed to be integrated into an LLM's model weights, particularly regarding copyrighted data available on the open web, so as I've mentioned before, highly regulated firms like hedge funds need to be aware of the risks and potential consequences.

AI-Related News & Research

- Bridgewater Launches AI-Driven $2 Billion Fund by Matt / AI Street

- LLMs are making alternative datasets ‘fuzzy’ by WatersTechnology

- AI for Hedge Funds Tracker by Alex Izydorczyk

- Top AI Tools for Financial Research by Nicole Sheynin

- Artificial intelligence has transformed financial research — raising the bar for its speed, effectiveness, and accuracy.

- The LLM Quant Revolution: From ChatGPT to Wall Street by William Mann

"This paper analyzes the application of Large Language Models (LLMs) in quantitative finance, focusing on:

- Current state of LLM technology in financial applications

- Comparative analysis of leading models. Implementation frameworks for production systems.

- Risk management and quality control considerations.

Key Findings:

- Multi-model approaches outperform single-model solutions.

- Production implementation requires robust quality controls.

- Model selection should be task-specific within the investment process."

- Age of AI: The latest on artificial intelligence in hedge fund operations by Hedgeweek

- Q2 Hedge Fund Manager Survey

- Fund types included in the survey:

- Mostly North American & European funds.

- Majority were smaller funds.

- Wide swath of flagship strategies, with the most common being equity long/short, digital assets and multi-strat.

- Mostly discretionary, with a skew towards traditional as apposed to tech-savvy styles.

- Main takeaways:

- North American funds are most advanced with AI.

- AI has demonstrated a worthwhile ROI.

- Half build solely in-house and half use vendors. A common, successful paradigm is customizing a model in house while leveraging third-party LLM models.

- Main use case is operational efficiency, but can also be used to reduce behavioural bias.

- Main road blocks are ease of use/integration, clear use cases and affordability.

- Unsuprisingly, smaller funds are more nimble and able to adopt AI more readily. Larger funds are taking a more targeted, methodical approach.

- Equity long/short strategies are the least likely to have implemented AI, while managed futures are the most, followed by crypto, macro and multi-strat.

- Fund types included in the survey:

- Q2 Hedge Fund Manager Survey

- Ep. 13 | Artificial Intelligence in the Financial Space by Hedgineer Technologies

- My Take: This podcast was published about a year ago, but Michael Watson is one of the most enlightened people on the subject of integrating the efficiency gains of generative AI into a hedge fund.

- Summary: Just about everything in the world of finance is data. It’s only a matter of time that the early adopters and educated users of AI will outrace their competitors to the top.

- In Episode 13 of the Hedgineer podcast, host Michael Watson interviews Rob Krzyzanowski, an expert in AI and machine learning with experience at notable firms like Avant, Spring Labs, and Citadel - and also a partner at Hedgineer.

- Rob offers his best-in-class view on the value of AI, and specifically, how it translates into platforms that can produce tangible results for hedge funds. We also get a simplified value proposition perspective for large language models, and how they're fundamentally changing the way funds operate.

- The conversation also provides a forward-looking view on balancing AI advancements and their application to:

- risk management

- stock classification

- operating efficiencies

- cost reductions

Data-Related Legal & Compliance News

- Reddit Sues Anthropic, Accusing It of Illegally Using Data From Its Site by The New York Times

- In its lawsuit, Reddit said Anthropic had also declined to enter into a licensing agreement for data and had unjustly enriched itself at Reddit’s expense.

- Disney, NBCU sue Midjourney over copyright infringement by Sara Fischer

- It's the first legal action from major Hollywood studios against a generative AI company.

- 📉 The Case That Won’t Go Away: What Yipit v. M Science Means for Jefferies by Case Watcher

- My Take: M Science v. Yipit might be actually go to trial! I can't imagine what the ultimate upside could be for either firm in continuing to air their dirty laundry in the courts and spend inordinate amounts on their lawyers...Maybe it's time to consider an alternative resolution?

- YipitData v. Marrale, M Science: The First Rat Jumps Ship by Case Watcher

- My Take: Alexander Pinsky tried to jump ship by implicating M Science's CEO Mike Marrale as the mastermind behind the conspiracy against Yipit, his former employer, and M Science's direct competitor. It seems the joint defense agreement is fracturing, with Pinsky and another Yipit defector, Zach Emmett, signaling different priorities than M Science and Marrale. This is shaping up as a potential train wreck for M Science and Jefferies, it's parent company.

- Hedge Fund Titan Millennium Faces Renewed Scrutiny Over Trade-Secrets Allegations by Case Watcher

- My Take: This case may rewrite the hedge fund talent-poaching playbook. One thing's already clear: don't take anything tangible, besides your experience and intellect, when moving from one fund to another.

- Trump Taps Palantir to Compile Data on Americans by Sheera Frenkel

- The Trump administration has expanded Palantir’s work with the government, spreading the company’s technology — which could easily merge data on Americans — throughout agencies.

- The ‘16 billion password breach’ story is a farce by Matt Kapko

"These massive dumps have been announced for years, and they are always a recycled pile of credentials with a few new ones sprinkled in"

Data Being Requested

If this request reasonably matches with a data product you represent or are aware of, please respond.

Alternative Data Sources Generally of Interest to Quant Funds

- Broad coverage of publicly traded companies (usually over 200-300 tickers in a dataset)

- Entities cleaned and mapped to identifiers, such as tickers

- Significant history (preferably 5+ years)

- Substantial historical data included in the trial

- Minimal lag and frequent updates

- Point-in-time data

- Reliable delivery infrastructure

- Data Categories of Interest (non-exhaustive): News, Financial Market, Jobs, Transactional, Geospatial/Location, Unstructured (Entities & Open Text), Events, Risk, Government

If you'd like us to source data that fulfills your unique requirements:

Data Providers & Products

If any of the following data providers piques your interest for any reason, respond and I'll share additional materials & directly introduce you, if necessary.

New Data Providers

- Atreides (Data Profile)

- Main Data Category: Location - Consumers & IoT

- Brief: Provides fused geospatial and sensor data from land, sea, air, cyber, and space domains to detect behavioral patterns, entity relationships, and anomalies for strategic and operational analysis.

- Canary Data (Data Profile)

- Main Data Category: Financial Data-Driven Investment Research

- Brief: Specializing in short-selling data points and workflow.

- Benjamin AI (Data Profile)

- Main Data Category: Financial Data-Driven Investment Research

- Brief: Platform that helps users research stocks, build and test investment strategies, and manage portfolios without needing to write code.

- edmundSEC (Data Profile)

- Main Data Category: Filing Data

- Brief: Offers access to SEC filings, earnings call transcripts, and financial tables.

- EDGEtimates (Data Profile)

- Main Data Category: Alternative Data-Driven Investment Research

- Brief: Provides real-time company KPI forecasts generated from alternative data sources such as transaction records, web traffic, app usage, and digital signals.

- Captide (Data Profile)

- Main Data Category: Filing Data

- Brief: Provides structured data and analytics extracted from corporate disclosures, such as 10-Ks, 8-Ks, earnings calls, and proxy filings, enabling the generation of real-time insights, comparison of company fundamentals, and streamlining of equity research.

- Hutong Research (Data Profile)

- Main Data Category: Investment Research

- Brief: Provides qualitative and thematic datasets on China’s political strategy, economic policy, US-China relations, and market dynamics, based on in-country analysis.

Partnerships + New or Updated Data Products

- Carbon Arc's updated Platform 2.0 automatically generating insights from alternative datasets by leveraging a proprietary knowledge graph and generative AI:

- S&P Global Market Intelligence Unveils GenAI-Powered Enhancements to Capital IQ Pro Platform by Michael Mayhew

- S&P Global Market Intelligence recently announced a series of GenAI-powered enhancements to its Capital IQ Pro platform, alongside expanded data coverage in the private markets and energy transition sectors. S&P Global’s recent product updates elevate the platform's Document Intelligence and charting capabilities, designed to empower users with advanced tools for strategic decision-making.

- Agentic AI comes to Bloomberg Terminal via Anthropic protocol by WatersTechnology

- Cloudflare rolls out ‘pay-per-crawl’ feature to constrain AI’s limitless hunger for data by djohnson

- The move is the result of customer feedback, since they neither wanted to grant AI web crawlers unrestricted access to their data nor block the practice entirely.

- Deep Lookup by Bright Data - Launch Event by Bright Data

- Meet Hatched IQ by Hatched Analytics

- Their report provides accurate predictions for Mercari’s Japan Marketplace GMV, and US Marketplace GMV KPIs, boasting a 6Q MAPE of just 1% and 2.1% respectively.

- Bloomberg Launches Company-Level Geopolitical Risk Scores Quantifying Country Risk, Built with Seerist Threat Intelligence by Bloomberg

- Bloomberg launches geopolitical country-of-risk scores for 7 million companies built with Seerist’s intelligence revealing 29 political, operational, security, cyber or maritime country-level threats impacting portfolios.

- Announcing the New Enigma Platform, Re-Architected for Programmatic Intelligence by Enigma Technologies

- LSEG officially sunsets Eikon by WatersTechnology

- Exabel Launches Hierarchical Modeling to Improve Company KPI Forecasting with Alternative Data by Hugh

- Exabel has introduced hierarchical modeling — a major upgrade to their KPI forecasting suite — designed to give buy-side investors more accurate, consistent, and insightful predictions using alternative data, including the ability to model profitability metrics.

- INRIX Partners with Maiden Century to Bring Connected Vehicle Data to Institutional Investors by Ashley Babani

- Acqwired Emerges from Stealth with Operating System for Private Equity Deal Sourcing by Acqwired

M&A

- Salesforce Signs Definitive Agreement to Acquire Informatica by Informatica

- My Take: Salesforce now owns Slack, Informatica, Tableau, and Mulesoft. These properties cover all the bases in the AI and data stack, so when will they all be merged together into a coherent data product stack?

- Stocktwits Acquires AI Startup Thematic to Power Social Investment Research in the AI Era by Stocktwits

"The enhanced platform will seamlessly integrate AI into all aspects of its user journey, including profiles, robust search capabilities, smart screeners and watchlists, recommended trade ideas, and stream summaries. The AI will wrap Stocktwits’ proprietary data to deliver tangible, actionable insights that cut through market noise and surface personalized ideas and analytics for each user exactly when they need them. Based on this new foundation, Stocktwits aims to redefine the future of investing by offering AI-powered, personalized agents that deliver timely insights to investors of all types and skill levels...

Stocktwits will release its new AI tools beginning in Q4 2025, which will also include an institutional-quality index builder with backtesting capabilities, democratizing access to portfolio-building tools that were previously only available to institutional investors."

- LightBox Acquires UrbanFootprint, Expanding Market-Leading Location Intelligence with Climate, Infrastructure & Demographic Data by Morningstar

- HG Insights Acquires TrustRadius to Revolutionize B2B Revenue Growth Intelligence by HG Insights

- HG Insights has acquired TrustRadius to combine market-leading technographics with trusted peer reviews—empowering go-to-market teams with unmatched buyer intelligence and intent signals.

- Envestnet’s Sale of Yodlee to STG: A Strategic Shift in Wealthtech by Michael Mayhew

- In a significant move within the financial technology sector, last week Envestnet, Inc., a leading wealth management technology provider, announced that it has entered into a definitive agreement to sell its open finance and data analytics subsidiary, Yodlee, Inc., to STG, a private equity firm specializing in software, data, and analytics companies.

- Oxford Economics Acquires Alpine Macro, Montreal-based Global Investment Research Firm by Oxford Economics

- Oxford Economics, the leading independent global forecasting and economics consultancy, has acquired a majority stake in Montreal's Alpine Macro.

- SPINS acquires Datasembly to deliver unmatched pricing and promotional intelligence for CPG brands & retailers by SPINS

- SPINS, the leading provider of data and analytics for the wellness-focused CPG industry, has acquired Datasembly, an industry pioneer in real-time, hyperlocal pricing and promotion intelligence. The acquisition creates the industry's most complete, transparent, and timely view of product pricing, promotion, assortment, and performance across the CPG landscape, empowering brands and retailers with mission-critical insights to operate, innovate, and grow.

- Slingshot Insights Acquires Noble Insights, Expanding Its Expert Network Platform to All Sectors by Business Wire

- Slingshot Insights, a leading expert network and investment research platform, announced its acquisition of Noble Insights, a global expert network.

- Sensor Tower acquires Playliner to expand mobile games data by Rachel Kaser

- Sensor Tower announced it has acquired Playliner, which will expand its coverage of mobile gaming data to include Live Ops.

- Feedzai Acquires Demyst: Data Orchestration for Fraud Prevention by Feedzai

- Feedzai acquires Demyst, merging data orchestration & AI for stronger fraud prevention. Enhance customer onboarding & get real-time insights.

Funding

- AgentSmyth Secures $8.7 Million Seed Round to Revolutionize AI-Driven Trading & Investing by Michael Mayhew

- AgentSmyth, a New York City-based provider of an autonomous agent platform that delivers institutional-grade market intelligence through five specialized AI agents, announced a successful $8.7 million seed funding round, co-led by FinTech Collective and Thomson Reuters Ventures, with participation from BNY.

- FinChat Rebrands to Fiscal.ai, Raises $10M Series A by Michael Mayhew

- AI-driven investment research platform FinChat recently completed a $10 million USD Series A funding round led by Portage with continued support from Social Leverage, and simultaneously announced its rebrand to Fiscal.ai. FinChat’s recent $10 mln capital raise brings the firm’s total funding to $13 million comprised of a $1.5 mln seed financing.

- Harvey raises $300 million at $5 billion valuation to be legal AI for lawyers worldwide by Alexandra Sternlicht

- Aiera Secures $25 Million in Series B Funding, Led by Wall Street Giants and Microsoft Partnership by Michael Mayhew

- Aiera, a New York-based provider of generative AI event solutions for global financial professionals, announced the successful closing of a $25 million Series B funding round, establishing a consortium of ten of Wall Street’s largest investment banks and research providers, including global expert network firm, Third Bridge.

- Windfall Secures $65 Million in Funding from Morgan Stanley Expansion Capital by Windfall Newsroom

- Windfall's recent $65M in funding from Morgan Stanley underscores its impressive growth, data quality and breadth, and its commitment to helping organizations implement data-driven and AI solutions.

- Investment in Quant Insight by 7Ridge's Ecosystem Impact Fun by BDO

- BondCliQ Secures Lead Investment from FactSet by Business Wire

16 Data Providers Featured

Recent News, Blogs & Podcasts

70 Featured Articles, including:

- 227 Sources of Alternative Data Content by Jordan Hauer

- The news, blog, podcast, and video feeds we pay the most attention to within the data or investing industries.

- Alternative Data Weekly #245 by John Farrall

- Theme: Clean Your House Before Inviting the Robots In

- Framing the Solution: Tracking the Real Impact of Tariffs with Alternative Data (Part I) by Jason DeRise

- A framework for data-driven investing that monitors tariff effects from supply chains to pricing and consumer trends before company results reflect the change.

- Framing the Solution: Tracking the Real Impact of Tariffs with Alternative Data (Part II) by Jason DeRise

"Seven-Step Framework for Tracking Tariff Impacts

- Monitor Tariffs and Exposure (Part I)

Track policy announcements and effective dates using official government data and understand corporate exposure.- Supply Chain Response (Part I)

Use AIS shipping data, bill-of-lading records, and port analytics to detect sourcing shifts and import behavior.- Logistics Tightness (Part I)

Monitor freight volumes, rail activity, and manufacturing job postings for signs of stress or adaptation.- Wholesale/Distributor Signals (Part II)

Analyze inventory levels, delivery timelines, and SKU4 availability from online sources and B2B platforms.- Retailer Adjustment (Part II)

Track real-time price changes, discounting patterns, and SKU churn to identify margin pressure and cost pass-through.- Consumer Reaction (Part II)

Use transaction data, price sensitivity models, and substitution patterns to assess spending behavior.- Company Results as a Signpost (Part II)

Apply NLP5 to earnings calls and investor communications to surface tariff exposure, strategic shifts, and risk language."

- Giuseppe Paleologo on Quant Investing at Multi-Strat Hedge Funds by Tracy Alloway

- My Take: A good overview of how basic quantitative hedge fund investing works. You can also find his book on this subject on Amazon.

- Hedge fund Millennium valued at $14bn in minority stake sale talks by Financial Times

- Izzy Englander’s group working with Petershill Partners as it opens up to external investors for the first time.

- Two-Minutes Ahead of the Future by Jason DeRise

- An odd night in a Boston hotel bar watching the Knicks-Pacers game becomes a parable about data, confidence, and the danger of being early.

- My Take: I will consume any content that mixes my beloved Knicks and alternative data...this might be the only article I've seen do that successfully.

- The Quantbot Episode by The Alternative Data Podcast

- A conversation with Paul White, CEO and co-founder of Quantbot, a quantitative hedge fund, talking about the challenges of launching a new hedge fund in 2009 and how they would be different now, and where he sees the opportunities and risks in today’s environment.

23 Events Featured

17 Upcoming Events, including:

- Quirk's Media's The Quirks Event New York 2025 starts on Jul 23, 2025 in New York.

- Amass Insights's Alternative Data Happy Hour in NYC #28 starts on Jul 24, 2025 in New York.

- Already have 107 RSVPs for this middle-of-the-summer happy hour!

- World Finance Conference 2025 starts on Jul 28, 2025 in Malta.

- Bloomberg Live's Sustainable Business Summit Singapore 2025 starts on Jul 30, 2025 in Singapore.

- Infopro Digital's Risk Live Australia 2025 starts on Aug 4, 2025 in Melbourne.

- Fund Business's 10th Annual Investment Data & Technology Summit starts on Aug 25, 2025 in Sydney.

- Two big asset management events in Australia in the same month?! This would've been a great excuse for me to go back down under again, but there's too much going on here in NYC!

- Fitch Learning, CQF Institute's AI and Machine Learning in Quant Finance Conference 2025 starts on Sep 17, 2025 online.

- A free online conference for CQF members, featuring 8 talks about the practical applications of machine learning and AI in finance.

- Eagle Alpha's Alternative Data Conference New York 2025 starts on Sep 17, 2025 in New York.

- Neudata's Traditional and Market Data Summit 2025 starts on Sep 18, 2025 in London.

- Cornell University's Financial Engineering Manhattan Future of Finance & Ai Conference 2025 starts on Sep 19, 2025 in New York.

- Amass Insights To Sponsor Cornell Financial Engineering's Future of Finance 2025 Conference by Rebellion Research

- I'll be there as we're sponsoring, excited to hear from so many big names in the quant investing space at my alma-mater.

6 Recent Events of Interest, including:

- Barclays' Data Science Research Conference happened on Jul 15, 2025 in New York.

- WatersTechnology's Waters Rankings 2025 happened on Jul 11, 2025.

- All the winners and why they won

- My Take: A little sad not to see any alternative data vendors outside of the big boys bring home awards.

- Amass Insights & Lowenstein Sandler's Alternative Data Breakfast Series #2: The Impact of AI on Institutional Investing happened on Jun 10, 2025 in New York.

- My expert panelists and I tackled maybe the most timely and buzzy topic in the asset management industry: how AI is transforming investing, particularly in the front office.

- Along with Lowenstein Sandler LLP & Boris Liberman, I co-hosted the second installment of our Alternative Data Breakfast Series where we explored the past, present and potential future of using AI within hedge funds & alternative data. Some takeaways from each of our panelists:

- Richard Rothenberg was the only academic on the panel (as well as being a practitioner founding Global AI) and educated the crowd about the origins of AI going back several decades, when it was usually referred to as machine learning or natural language processing. Him and I had a friendly disagreement on the potential for using synthetic data in augmenting smaller sample sizes in the future.

- Michael Watson described how his company Hedgineer rapidly spins up full data infrastructures for new or emerging hedge funds including really clean, reconciled data linking together a security master, entity master and position master. He championed the revolutionary, newly-released Claude Code product and its countless use cases, such as automatically building comprehensive data documentation from previously unknown alternative datasets.

- Evan Reich delved into how he leverages AI to increase efficiency when "buying all the things" for Verition Fund Management LLC. He leverages LLMs to automate some of the steps in repeatable data sourcing workflows.

- Boris Liberman has been working with both asset managers and data providers to update their licenses and policies to reflect the new concerns that arise from employing generative AI.

- And I explained how I've built a digital personal/executive assistant that automates and enhances labor-intensive parts of my daily work. Some tools and use cases I mentioned: Howie for scheduling, Zapier for linking together everything including meeting prep, Granola for taking meeting notes, and ChatGPT for content editing.

- Thanks to everyone who joined and special thanks to my panelists! Let me know if you'd like the invite to the next one.

- BattleFin's BattleFin Discovery Day New York 2025 happened on Jun 10, 2025 in New York.

- Top Questions: BattleFin Discovery Day New York, 2025 by Jason DeRise

- Technological innovations like generative AI & public policy shifts like Trump #47 were key points in our fireside chat about the latest guidance and best practices for alternative data onboarding & due diligence. At BattleFin last month, Boris Liberman, George Danenhauer and I discussed a number of topics that should be on the radar of the legal and compliance officers at both alternative data providers and buyers, such as:

- recent federal de-regulatory efforts leading to a continuation of state data laws, most recently Delaware and New Jersey, and the first state AI legislation in Texas

- best practices for hedge funds when integrating AI into their investment processes, including recordkeeping, explainability, AI-specific policies & procedures, AI-specific due diligence on vendors, and AI-specific clauses within contracts with vendors

- best practices for data providers when using AI in their data products, including diligencing your internal AI systems, adding additional details to your DDQs relating to your usage of AI, and updating your data license agreements to reflect IP rights and protections in the age of AI

- Amass Insights's Alternative Data Happy Hour in NYC #27 happened on Jun 3, 2025 in New York.

- My happy hours just seem to keep growing, with 110 attendees this time!